January 10, 2026 marks a pivotal moment for Hermès enthusiasts tracking the investment value of the ultra-coveted Mini Kelly II. Following staggered price adjustments at the start of the new year—with Europe seeing an upward revision on January 2nd and the U.S. market adjusting in the preceding week—the perennial question resurfaces: does the allure of purchasing this iconic handbag abroad still translate into tangible financial benefits? This installment of Handbag Math meticulously dissects the freshly mandated 2026 price structures across the Atlantic and provides a five-year retrospective on the Mini Kelly II’s appreciation, evaluating whether the historical savings advantage of European acquisition remains viable.

For years, securing a Mini Kelly II in major European hubs like Paris offered substantial cost avoidance compared to the U.S. retail price. However, the narrative surrounding international acquisition is increasingly complicated by logistical hurdles and evolving boutique policies. For travelers without an established, high-spending relationship with a Sales Associate (SA) in a European flagship store, the pursuit of an in-store leather appointment has become an exercise in extreme patience and often, deep frustration. Reports from the luxury community indicate that SAs in Paris are now more overtly encouraging local clientele to concentrate their purchasing power within their home regions, subtly dampening the incentive for international "quota bag tourism." Even for those who successfully navigate the appointment lottery or manage a rare walk-in success, the dialogue often ends with the familiar, though disheartening, refrain: "We do not have any Kellys or Birkins available today." The Mini Kelly II, in particular, remains one of the most difficult styles to encounter, regardless of geography.

The 2026 Financial Breakdown: Paper vs. Reality

The most recent price increase has, paradoxically, widened the nominal monetary gap between the two regions. The new baseline pricing, when calculated against the current exchange rate, presents a compelling—yet potentially misleading—scenario.

As of January 1, 2026, the Euro (€) conversion rate stands at approximately $1.17 USD.

| Region | Hermès Mini Kelly II (Epsom Leather) 2026 Retail Price | Calculation Notes |

|---|---|---|

| United States (USD) | $11,400 | Latest official U.S. retail price. |

| Europe (EUR) | €8,000 | New January 2, 2026 European price. |

| VAT Refund Potential | ~€800 (Approx. 10% of retail) | Estimated refund upon export. |

| Net European Cost (USD) | ~$8,424 USD | (€7,200 net cost converted at $1.17/€). |

| Total Potential Savings | $2,976 USD | $11,400 – $8,424 |

On the surface, the calculated savings of nearly $3,000 USD is significant. This figure represents an increase in savings compared to the post-tariff adjustments observed in mid-2025, suggesting that currency fluctuation and regional pricing strategies have favored the European buyer this year—at least mathematically.

However, this "Handbag Math" deliberately omits several critical variables that dramatically affect the true out-of-pocket cost for the American traveler. These include:

- Ancillary Travel Expenses: Round-trip airfare, multi-day accommodation, ground transportation, and daily dining costs in major European capitals quickly erode thousands of dollars from the theoretical savings.

- Customs and Duties: The cost of re-entry into the U.S., including potential state-specific sales tax upon declaration, must be factored in.

- Opportunity Cost: The sheer time commitment required to secure an appointment, wait for a potential offer, and manage international logistics represents a significant investment that many find too high for a single acquisition.

When these real-world costs are tabulated, the perceived $2,976 savings can rapidly shrink, making the convenience and guaranteed purchase opportunity at a domestic boutique far more appealing.

Five Years of Escalation: A Pricing Trajectory

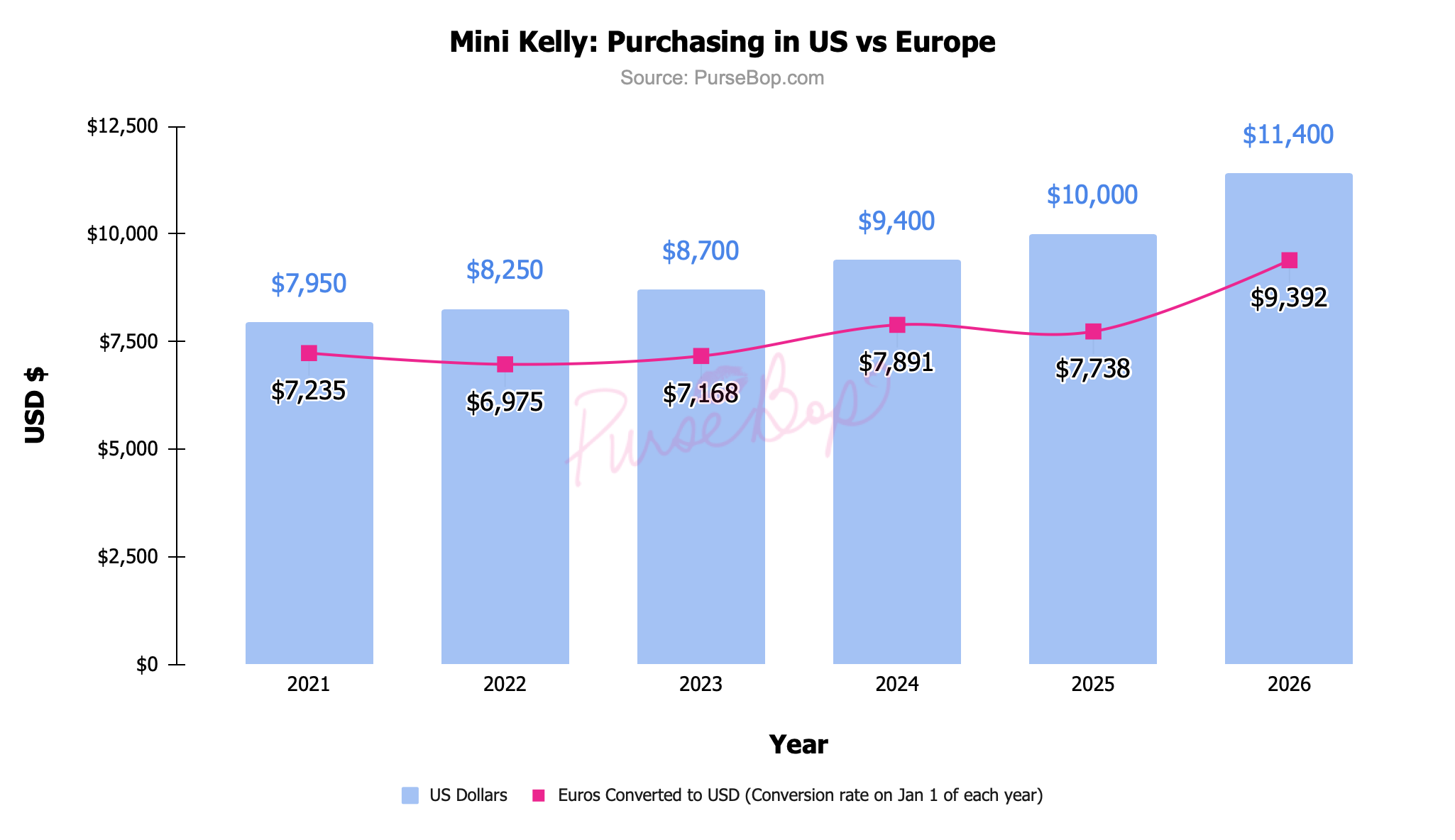

To understand the current landscape, one must examine the sustained trajectory of Hermès price increases over the last half-decade. The Mini Kelly II has been a prime example of consistent asset appreciation across the brand’s portfolio.

United States Pricing Trend (2021 – 2026):

In 2021, the U.S. retail price for the Mini Kelly II was approximately $7,950. By 2026, this has escalated to $11,400. This represents an overall increase of $3,450, translating to a staggering 43.4% appreciation over five years—an average annual increase hovering around 8.5%. The most recent 2026 hike was notably substantial, underscoring inflationary pressures, strategic positioning, and potential tariff impacts factored into the U.S. market structure.

European Pricing Trend (2021 – 2026):

Europe has exhibited a more measured, albeit still significant, upward trend. In 2021, the bag was priced around €5,900. The 2026 price of €8,000 reflects a €2,100 increase, or a 35.6% rise over the same period. This averages out to an annual increase closer to 7%.

Analyzing these five-year charts reveals a pattern of relentless price inflation globally. While U.S. prices have increased at a slightly faster cumulative rate, the overall result is a rapidly appreciating asset regardless of where it is purchased. This dynamic reinforces Hermès’s strategy: maintaining desirability through scarcity and consistent price escalation, ensuring their bags function effectively as high-performing alternative assets.

Conclusion: Opportunity Trumps Price

The core takeaway for 2026 is that while the theoretical price advantage of buying the Mini Kelly II in Europe persists, the practical advantage has significantly diminished. The scarcity of inventory in Paris means that a shopper is trading substantial financial savings for a high probability of returning home empty-handed after incurring significant travel expenses.

For the dedicated collector, the "smartest handbag math" is shifting away from pure arithmetic. It is increasingly about maximizing opportunity. If a shopper is fortunate enough to receive an offer from their local boutique—even at the higher $11,400 price point—the value of immediate acquisition, guaranteed leather quality inspection, and avoiding international travel stress often outweighs the potential $3,000 paper saving.

In the current environment, where the Mini Kelly II is virtually unattainable on demand anywhere in the world, the optimal strategy remains simple: acquire the bag when and where it is offered. The romance of the Parisian shopping trip is increasingly outweighed by the cold, hard reality of securing the prize itself.